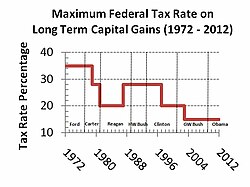

Pat, take a look at this graph of historical capital gains tax treatments. Could you tell me when thirst for investment and capital gains profits, waned, and when there was no investment economic incentive to put money to work? Can you tell me when these years on the graph had equal tax treatments of capital gains income with ordinary income, and there weren't favored lower than ordinary income? Never?

Also, can you tell me when the term irrational exuberance was cautioned, and how that worked out for a crescendo of so-called 'investment' incentivized activity, and what the consequences of all that was for our overall economic well-being as a nation? Hint hint, something to do with Sept 2008, greed, no cop on the beat, and yes, the lowest cap gains rate in history in place for 7 years, which currently remains at said low levels.

I was wondering Pat, if you could look at the graph and tell me at what point in the cap gains rate history, the great outsource and moving of invested capital from formerly American based companies occurred most? Could it be that despite the lowering of the cap gains rate to their historical lowest, that greed for more and more, at the expense of American jobs, and tax base on these invested capitalized companies still turned their backs on the vast majority of their own people in search of higher and higher profits, and our unpaid-for tax breaks and lowering of rates that added to our debt, just were as always, not good enough for the greedsters?

Now we hear the same old same old; 'raise our taxes and we'll flee, sit on our wealth, and clip coupons'. We have heard it before, dire warnings, etc., and in earlier years when the warnings were novel, we believed it may be so. But then we learned it was a canard, and greed for more retained wealth via tax favoritism will not be made to work for the middle class working families needing jobs and decent wages from capital invested in companies in flight, no matter what and how low the taxes become.

So why not go back to rates where economic activity was certainly no worse, and count on greedy and profit thirsty people will invest at any rate, literally. They always have bought and traded stocks, built buildings, opened businesses, at all these cap gains rate, and it is hard to imagine greed and profit motive will take a sabbatical for an increase of 4-5% increased tax rates, cap gains or ordinary.